Advocacy

Giving brokers a unified voice to influence policy and protect industry interests.

Items We Are Affecting For You Us The Community

SBA SOP 50‑10‑8

The SBA has updated its Standard Operating Procedures (SOP 50 10 8), setting the standard for how 7(a) and 504 loans are originated. This clarity makes it easier to package deals, align with lenders, and get to funding faster. While lenders are responsible for compliance, brokers play a critical role in helping applicants meet the SBA’s streamlined documentation and eligibility requirements. We actively monitor SOP updates and equip brokers with training, templates, and support tools to ensure you’re never left behind.

Learn More

Commercial Financing Disclosure Law, Mo. Rev. Stat. Chapter 427

Missouri has introduced a commercial financing disclosure law that requires brokers to register with the Division of Finance. This is a positive step for legitimate brokers. It helps build trust with lenders and borrowers by cracking down on bad actors.

Learn More

Texas Finance Code Chapter 398 (HB 700)

Texas recently enacted a law that establishes broker registration and common-sense disclosure requirements for sales-based financing (MCA). It also sets boundaries that protect small business owners while empowering brokers to build credibility and operate transparently. The CCBA fully supports regulation surrounding the MCA product.

Learn More

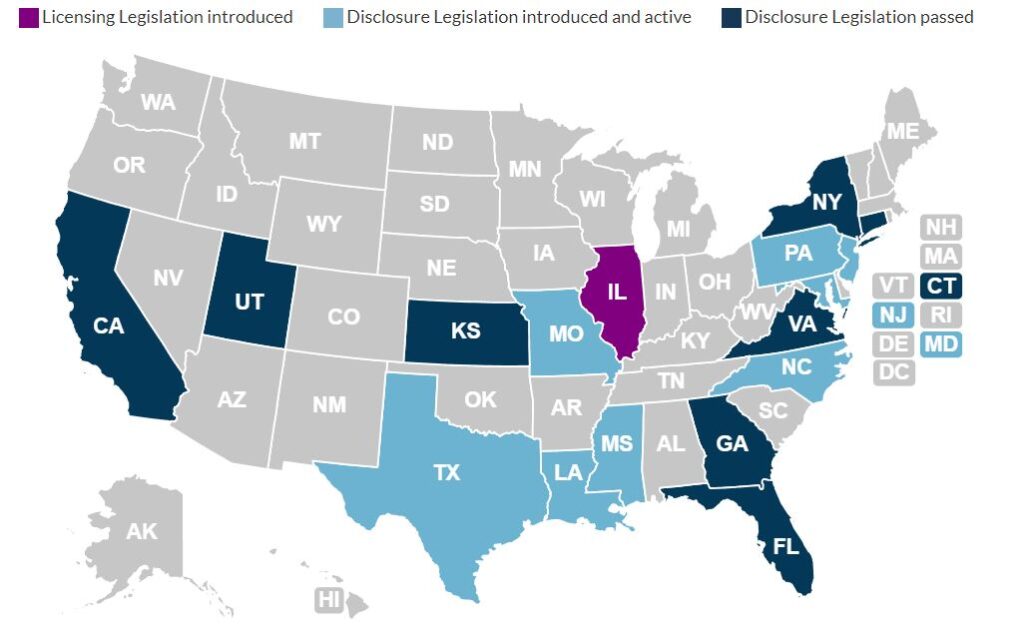

Commercial Financing Disclosure Law or Act(s)

States like California, New York, Florida, Georgia, Kansas, and Connecticut have passed commercial financing disclosure laws that impact how cost, fees, and broker compensation are disclosed to borrowers. Each state’s rules are slightly different, but they all share a common goal of transparency. Brokers are not required to create disclosures, but in many cases, you must ensure the provider’s disclosures are delivered correctly. This wave of legislation shows just how important brokers are to the small business funding ecosystem. We are proud to be your advocate and your compliance partner.

Learn More

Submit An Issue For The Designated Regional Team To Review. We will take the appropriate action(s)

Your Community

At the Commercial Capital Broker Association, we are dedicated to fostering strong relationships and empowering success within the commercial capital broker industry. Through collaborative efforts and a commitment to excellence, we provide brokers with the tools, resources, and support they need to thrive in today’s competitive market.

Commercial Capital Brokers in our community.

Gain access to an ecosystem of lenders, resources, tools, and support.

Our mission for

Your Community

Our mission at the Commercial Capital Broker Association is to champion the interests and development of brokers while upholding lender integrity and fostering a holistic commitment to the communities we serve. We strive to empower our members through advocacy, education, and innovative resources, ensuring ethical business practices and promoting sustainable growth. Together, we aim to create a thriving financial ecosystem that benefits all members.

Get In Touch With Us

We are here for you. Brokers Do It Better!

Commercial Capital Broker Association

Tampa, FL | Phone: (813) 694-9119