ADVOCACY

Items We Are Affecting For You Us The Community

SBA SOP 50‑10‑8

The SBA has updated its Standard Operating Procedures (SOP 50 10 8), setting the standard for how 7(a) and 504 loans are originated. This clarity makes it easier to package deals, align with lenders, and get to funding faster. While lenders are responsible for compliance, brokers play a critical role in helping applicants meet the SBA’s streamlined documentation and eligibility requirements. We actively monitor SOP updates and equip brokers with training, templates, and support tools to ensure you’re never left behind.

Learn More

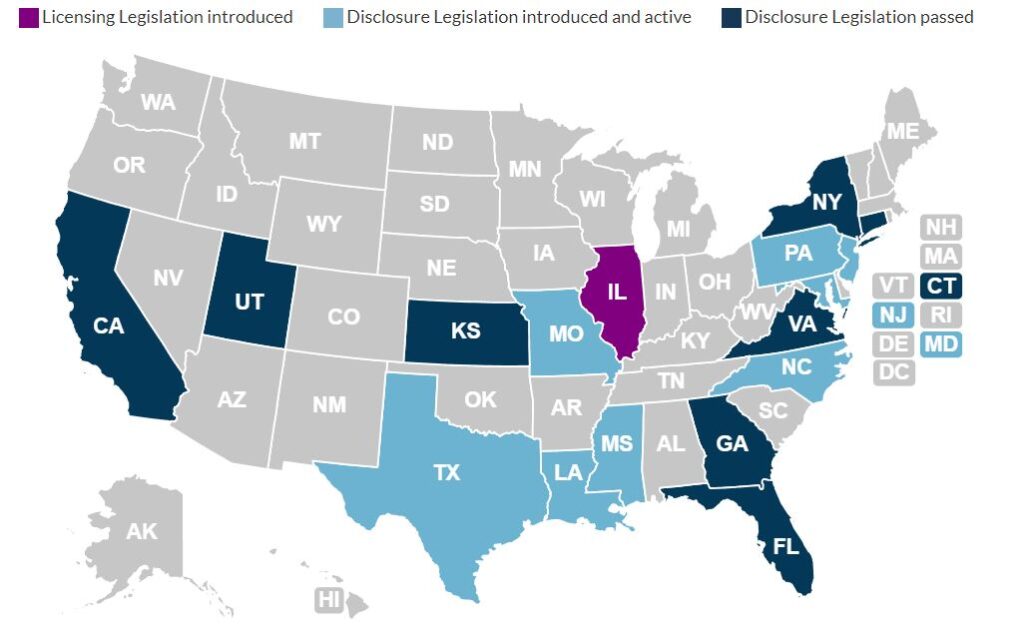

Commercial Financing Disclosure Law, Mo. Rev. Stat. Chapter 427

Missouri has introduced a commercial financing disclosure law that requires brokers to register with the Division of Finance. This is a positive step for legitimate brokers. It helps build trust with lenders and borrowers by cracking down on bad actors.

Learn More

Texas Finance Code Chapter 398 (HB 700)

Texas recently enacted a law that establishes broker registration and common-sense disclosure requirements for sales-based financing (MCA). It also sets boundaries that protect small business owners while empowering brokers to build credibility and operate transparently. The CCBA fully supports regulation surrounding the MCA product.

Learn More

Commercial Financing Disclosure Law or Act(s)

States like California, New York, Florida, Georgia, Kansas, and Connecticut have passed commercial financing disclosure laws that impact how cost, fees, and broker compensation are disclosed to borrowers. Each state’s rules are slightly different, but they all share a common goal of transparency. Brokers are not required to create disclosures, but in many cases, you must ensure the provider’s disclosures are delivered correctly. This wave of legislation shows just how important brokers are to the small business funding ecosystem. We are proud to be your advocate and your compliance partner.

Learn More

Advocating for Commercial Capital Brokers

Championing fair regulation, transparent processes, and equitable compensation at the federal and state level.

Federal and state bill tracking

Direct outreach to agencies and legislators

Broker compensation and fee protection

Process transparency and disclosure standards

Our Mission in Advocacy

We represent the collective voice of commercial capital brokers nationwide. Our advocacy is focused on shaping policies that protect brokers, enhance market transparency, and ensure access to fair and competitive financial products for businesses.

Federal Advocacy

Driving Policy at the National Level. Engage with legislators on Capitol Hill to address lending regulations that impact brokers and small business clients. Advocate for fair oversight that encourages competition rather than restricting broker opportunities. Build strategic relationships with federal agencies to ensure the broker community has a seat at the table when financial policies are shaped.

State-Level Advocacy

Protecting Brokers in Every State. Monitor and respond to proposed state legislation that may restrict broker activity or unfairly increase compliance burdens. Partner with state associations and chambers to strengthen the broker community’s local presence. Provide brokers with alerts, guidance, and resources on state regulatory changes.

Key Advocacy Priorities

Issues That Matter Most to Brokers. Compensation: Defending fair compensation structures that reward brokers for their expertise and risk management. Negotiation: Supporting the broker’s role in negotiating terms that work for both borrowers and lenders. Transparency: Promoting clear, honest processes so clients and lenders understand the true value brokers provide. Industry Standards: Working toward best practices that elevate the reputation of commercial capital brokers.

Engagement and Relationships

Building Influence Through Unity. Our strength is in our community. By uniting brokers, lenders, and stakeholders, we amplify our voice in policymaking circles. Through grassroots campaigns, coalition partnerships, and direct engagement with decision-makers, we ensure that the needs of commercial capital brokers are heard and respected.

Get Involved

Stand with Us. Your involvement strengthens our advocacy. Join committees, attend briefings, and participate in campaigns that shape the future of our industry. Together, we are building a sustainable, respected, and powerful broker community.

Building Influence Through Advocacy

Uniting brokers, lenders, and stakeholders to create meaningful change in policy and practice.

Federal Engagement

We monitor and respond to legislation in Washington that impacts brokers. From lending regulations to oversight rules, we make sure the broker community is represented in national policy conversations.

State-Level Action

Our advocacy teams track state proposals, build coalitions, and support local brokers in defending fair practices and balanced regulation.

Broker Priorities

We fight for issues that matter to brokers most; compensation protection, negotiation rights, and transparent processes that strengthen trust between brokers, lenders, and clients.